The chart of accounts, generally, is a list of financial activities comprising assets, liabilities, equity, revenue, and expenses to be tracked or accounted for and reported in the financial statements. These activities are usually classified based on standard accounts groups and categories, with each item in the chart assigned a unique code. A well-structured chart of accounts will map directly into the financial statements.

One of the goals of IPSAS is the attainment of uniform accounting measurements and reporting across the various tiers of government to enable comparability of financial information. The only way this IPSAS objective can be achieved is by ensuring that all tiers of government use a uniform chart of accounts and reporting template. The development of a custom Chart of Accounts is one of the domestication tasks required to be carried out by each Jurisdiction for the implementation of IPSAS.

As part of the initial preparation toward readiness for the takeoff of IPSAS implementation nationwide, the Federation Account Allocation Committee (FAAC) Sub-Committee on IPSAS, under the Office of the Accountant-General of the Federation, had released the National IPSAS Chart of Accounts to enable uniform classifications and reporting across all tiers of government in Nigeria. Also released along with the National Chart of Accounts were the templates for the General-Purpose Financial Statements (GPFS), comprising Statement of Financial Position, Statement of Financial Performance, Statement of Cash Flows, and Statement of Change in Equity. The GPFS are meant to provide a uniform reporting template to enable entity-wise comparison and evaluation of financial information.

The first National Chart of Accounts was released for the take-off of the Cash-based IPSAS in 2013, while the present Chart of Accounts was released for the Accrual-based IPSAS implementation, which commenced in 2015. The Accrual-based Chart of Accounts is different in structure and coding convention from the pre-2013 Cash-based Chart of Accounts. However, national budgets are still based on the Cash-based codes.

The National Chart of Accounts defines all the financial and economic activities to be accounted for by the three tiers of governments (comprising Federal, State, and Local government), as well as the ministries, departments, and agencies (MDAs). This provides a uniform template for the classification, coding, and presentation of economic and financial activities in all three tiers of government. The financial statements and budgets of the central governments and those of their MDAs are expected to be based on the National Chart of Accounts.

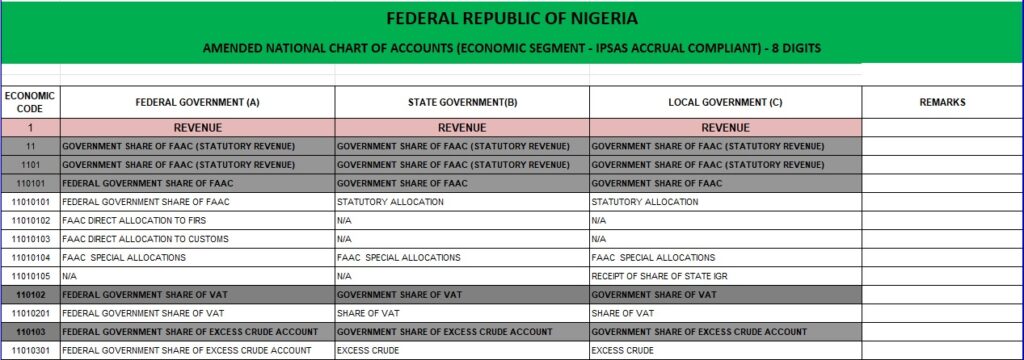

The National IPSAS Chart of Accounts has entries for each tier of the public sector as shown in the sample below:

THE COMPOSITION OF THE NATIONAL CHART OF ACCOUNTS

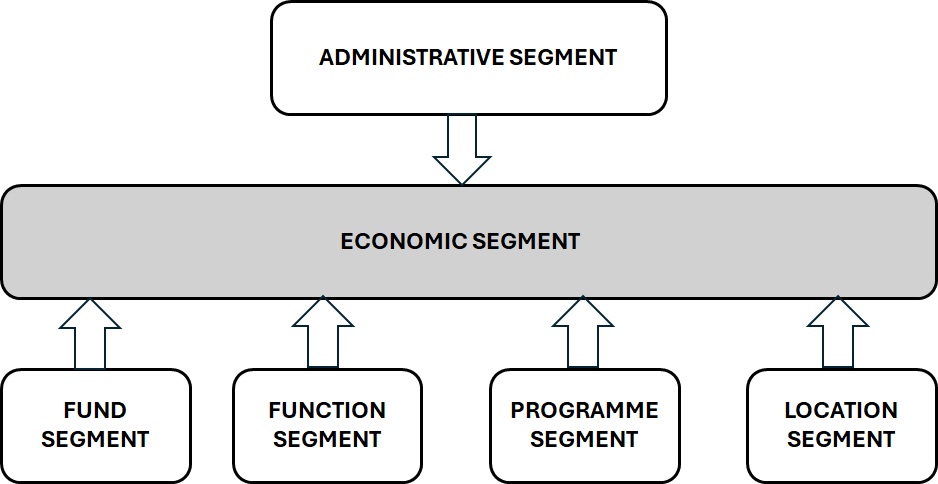

Technically, what is referred to as the national Chart of Accounts comprises the six segments listed below.

Economic Segment

This represents the headings, sub-headings, and descriptions of items, covering all economic activities to be accounted for under the following primary categories: Income, Expense, Assets, and Liabilities. Each line item is represented by a unique code of 8 digits, followed by a description. This is the core part of the National Chart of Accounts, and it is what most people understand as the National Chart of Accounts.

The Economic is the most fundamental segment of the National Chart of Accounts, and it is the hub to which all the other five segments are connected. None of the other segments can function without it.

Administrative Segment

This segment identifies the sub-entities or organisations—Ministry, Department, or Agency (MDA)—where the economic and other financial activities originate. This is like the Operating Segment under IFRS. Each organisation is assigned a unique code and description, and each must be assigned to one of the five administrative sectors (Administration, Economic, Law and Justice, Regional, and Social)

Under IPSAS, each organisation or agency under a central government is required to prepare its independent financial statements and budget reports outside the consolidated financial statements and budget reports prepared by the central government.

Fund Segment

The Fund segment tracks the various funds used for financing relevant economic activities under the Economic segment. This may include Direct Allocation from the federation account, Capital Development Fund, Contingency Fund, Education Tax Fund, funds from loans and donor agencies, etc. The Fund Segment is mandatory for all MDAs.

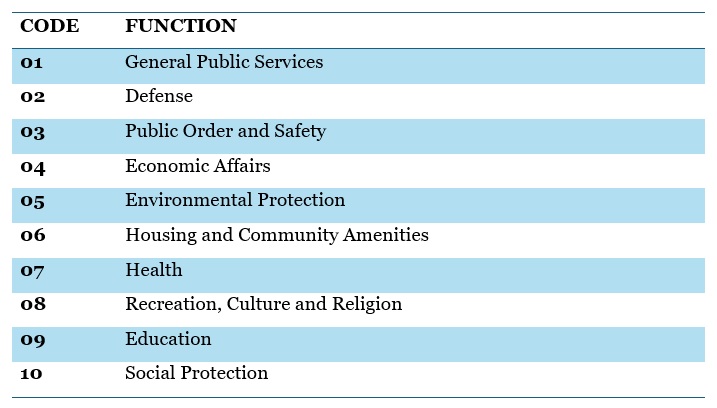

Function Segment

The Function segment enables the mapping and grouping of each economic activity under the Economic segment into the various functions and objectives of the government. This will make it possible to analyse the performance of the budget based on the various functions of the government. This is one of the requirements of the United Nations, which has released a standard list called Classification of the Functions of Government (COFOG). Below are the ten most common items under COFOG:

Many countries have adopted this list and domesticated it to suit their national requirements. The present National Chart of Accounts has subdivisions for the Function Segment.

Classification by Functions can reveal a lot about government policies and how they will affect the people. If one were to ask, “What is the purpose of this government?” Functional classification of the budget will answer that question. It will show whether the country is preparing for war with external enemies or is at war with itself; it will tell you whether the government cares more about a healthy and educated populace than building more prisons to accommodate more miscreants.

Programme Segment

Capital Projects are grouped according to defined government programmes and projects. The Programme segment identifies each project and associates it with the Economic and Administrative Segments. Each Programme can be subdivided into specific Projects. This classification enables the tracking and production of financial and budget reports based on these government programmes/projects.

The Programme Segment is mandatory for consolidated accounts at the Federal, State, and Local Government levels. However, the list of specific programmes and projects is entity-dependent.

Geographical Location Segment

This is meant to track and classify capital projects based on the geographical locations where those projects are located. This enables the government to know how Capital Projects are spread among the various regions and localities. The Location Segment is also mandatory for consolidated accounts at the Federal, State, and Local Government levels and is entity-dependent.

HOW TO WORK WITH THE NATIONAL CHART OF ACCOUNTS

With about 900 line items, the National Chart of Accounts is vast and is not something you can cram. Apart from this, account names are not unique. If you decide to go by the name, it is easy to get things messed up. For example, accounts 32030109 and 44030106 have the same name, RESEARCH & DEVELOPMENT. However, the first one is an asset, while the second one is an expense. One way of avoiding such conflicts when using the National Chart of Accounts is to understand its coding convention. To avoid name conflict, it is advisable to identify each account by its base class code (the first digit of the account code).

The base codes used in the National Chart of Accounts are as follows:

- 1 = REVENUE

- 3 = EXPENDITURE

- 3 = ASSET

- 4 = LIABILITY

Taking note of the first digit of the account code will ensure you do not mistakenly recognise an asset as a liability, income as an expense, and vice versa. Thus, all the Revenue accounts begin with 1, Expenditure with 2, Asset with 3, and Liability with 4. In the above example, the first account is Research and Development expense, while the second is an investment in Research and Development, which is capitalised as an asset.

The National Chart of Accounts is the fulcrum of IPSAS implementation. It provides the basis for uniform reporting and a common template for comparing financial statements from all levels of government across the country. It is the first and most fundamental level of compliance with IPSAS. Non-compliance with the National Chart of Accounts means non-compliance with IPSAS.

You will find a detailed analysis of the National IPSAS Chart of Accounts, and all the technical issues and challenges involved in its maintenance in the book, IPSAS IMPLEMENTATION AND THE SYSTEM CHALLENGE: THE NIGERIAN EXPERIENCE.

Reliable Solutions to Guarantee Excellent Results and Maximum Satisfaction

We understand IPSAS policies and requirements; we understand your needs and Nigeria’s domestication requirements That is why our ExpressBook PSA IPSAS-Compliant accounting software for public sector entities is preloaded with the Economic, Fund and default Function Segments of the National Chart of Accounts. Also included as standard are the General-Purpose Financial Statements (GPFS), based on the custom template provided by the Office of the Accountant-General of the Federation (OAGF).

You can rely on us for special training and workshops on IPSAS implementation and compliance.

Leave a Reply