First-time adoption is a standard procedure required for all entities adopting IPSAS or IFRS for the first time as the mandatory first step towards full IPSAS or IFRS adoption and compliance. The First-Time Adoption process constitutes an important part of IPSAS Transition Management. Even if a public sector entity is newly created, some rudimentary financial records exist in one form or another. These records must be transitioned from the old bookkeeping system to the accrual IPSAS-compliant format. This is what the First-Time Adoption of Accruals IPSAS is all about.

First-Time Adoption (IPSAS 33) as a Mandatory First Step for the Accrual IPSAS Adoption

First-time adoption is a standard procedure required for all entities adopting IPSAS or IFRS for the first time as the mandatory first step towards full IPSAS or IFRS adoption and compliance. The First-Time Adoption process constitutes an important part of the IPSAS Transition Management, which I discussed in my previous post on the IPSAS IMPLEMENTATION AND COMPLIANCE FRAMEWORK.

Even if a public sector entity is newly created, some rudimentary financial records exist in one form or another. These records must be transitioned from the old bookkeeping system to the accrual IPSAS-compliant format. This is what the First-Time Adoption of Accruals IPSAS is all about.

IPSAS 33 is the Standard that prescribes the requirements for the First-Time Adoption of accrual IPSAS. The general recommendation for first-time adoption of the Standards stipulates retrospective preparation of the Opening Statement of Financial Position (Balance Sheet), based on the following criteria:

- Recognising all assets and liabilities whose recognition is required by IPSAS and not recognising items as assets or liabilities if IPSAS does not permit such recognition.

- Reclassifying items that are recognised/derecognised in accordance with the recognition criteria of IPSAS.

- Applying the IPSAS measurement policy to all recognised assets and liabilities.

Because the First-Time Adoption requirements apply mostly to assets and liabilities, the process may not be mandatory or even necessary for the adoption of the Cash-based IPSAS.

As part of the preliminary requirements for the First-Time Adoption of IPSAS, it might also be necessary to carry out the following tasks before preparing the Opening Statement of Financial Position:

- Quantify all the adjustments to be carried out to align assets and liabilities with IPSAS measurement policies.

- Identify and fill in all data gaps arising from discrepancies in the classification and reclassification exercise.

- Create standard templates for IPSAS Financial Statements (in the absence of an automated IPSAS-compliant reporting system).

Entities are required to apply all applicable Standards retrospectively as of the closing Balance Sheet date for their first IPSAS financial statements before the transition date. This means if the transition date is 01/01/2016, the standards should be applied in the period 01/01/2015 to 31/12/2015, to produce the closing Balance Sheet (Statement of Financial Position), which will serve as the IPSAS Opening Balance for 01/01/2016.

In addition, IPSAS recommend, as a note to the Closing Statement of Financial Position, disclosures that explain how the transition from previous standards has impacted the entity’s reported Financial Position, Financial Performance, and Cash Flows in the previous year, before IPSAS adoption.

Entities adopting IPSAS for the first time need to refer to IPSAS 33 for updates on any new requirements under the standard.

Key Implementation Tasks and Challenges

Recognition and Classification are the most crucial parts of the tasks required for the First-time Adoption process. This task is more challenging for entities operating on a cash basis, where there is no provision for the recognition of Capital Expenditures as Assets. A lot of effort will be required for the classification and valuation of non-current assets. The transition from Cash-based IPSAS to the Accrual Standards will not only require the recognition of cash and bank balances as Current Assets; it will also require the recognition of all existing assets and liabilities, which must be measured based on their carrying or fair values, as at the date of transition. Apart from Cash and Bank Balances, the entity must provide accurate information about the following, among others:

- Prepaid Expense

- Debtors’ Receivables (or Revenue in Arrears)

- Noncurrent Assets

- Vendors’ Payables

- Short/Long Term Debts

- Unearned Revenue or Income

Most of the items classified as Capital Expenditure (under the Cash-based IPSAS) must be reclassified as Non-current Assets; all prepaid expenses and receivables must be recognised and classified as Current Assets, while all outstanding vendors’/creditors’ commitments, Unearned Revenue, should be recognised and classified as Current Liabilities. Long-term loans should be recognised and classified as Long-Term Liabilities.

Sadly, none of these records are present on the face of the Revenue and Expenditure Statement produced by the Cash-based accounting system. That means a lot of paperwork will be required to retrieve and collate all relevant data.

Irrespective of the accounting method or system an entity was using before the adoption of IPSAS, there is a need for every First-time adopter to have a plan that will enable it to transition smoothly to the new IPSAS-compliant environment. This plan must include, at least, uniform rules and criteria for the Classification and Measurement of existing assets and liabilities.

Classification

It is not likely that the previous chart of accounts will map directly into the IPSAS chart of accounts. Even if account names are identical, the codes are not likely to be the same. Therefore, there must be an algorithm to map the entries in the current chart of accounts into the IPSA chart of accounts.

You must ensure that the major account heads and their sub-groupings agree with the classification used in the IPSAS chart of accounts for all items of Revenue, Expenditure, Assets, and Liabilities—not according to the order in the previous chart of accounts. Close all the relevant data gaps by ensuring that each item in your previous chart of accounts finds its exact or approximate correspondence in the IPSAS chart of accounts.

Note that it might become necessary to reclassify some of the items. For example, Books are sometimes classified as Noncurrent (Fixed) Assets, but they are classified as expenditures in the IPSAS National Chart of Accounts. The same treatment applies to computer software. However, if an item meets the requirements for recognition as Non-current assets but has no direct correspondence in the National Chart of Accounts, you may consider mapping such an item to its closest approximation in the National Chart of Accounts. For example, you can consider mapping important books of historical significance to Patent Rights, Copyright, Franchise, or Research & Development, under the INTANGIBLE ASSETS group.

Let me warn those who have not worked closely with the current Nigerian National IPSAS Chart of Accounts in advance that Non-current Assets classification is one of the most unwieldy sections of the National Chart of Accounts. A lot of work still needs to be done here. I will discuss the challenges involved in accounting for Non-current assets in a subsequent post.

Measurement

Prepare the closing balance from your current accounting system for the previous year’s transactions. The Carrying Values (or Net Book Values) for Non-current assets that have been in operation must be computed using the most feasible accounting method. Where such values are not readily available, the best estimate must be obtained based on the Fair Value principle. These figures will be your IPSAS transitional opening balance. Be sure to make all the necessary adjustments and corrections before preparing the closing balance.

Let me conclude by pointing out that most of the decisions you will need to make in your IPSAS transition journey, especially concerning the classification and reclassification of assets and liabilities, will require professional judgment. This is why you must include your Auditors in your IPSAS transition management team.

Practical Solution to Key Implementation Challenges

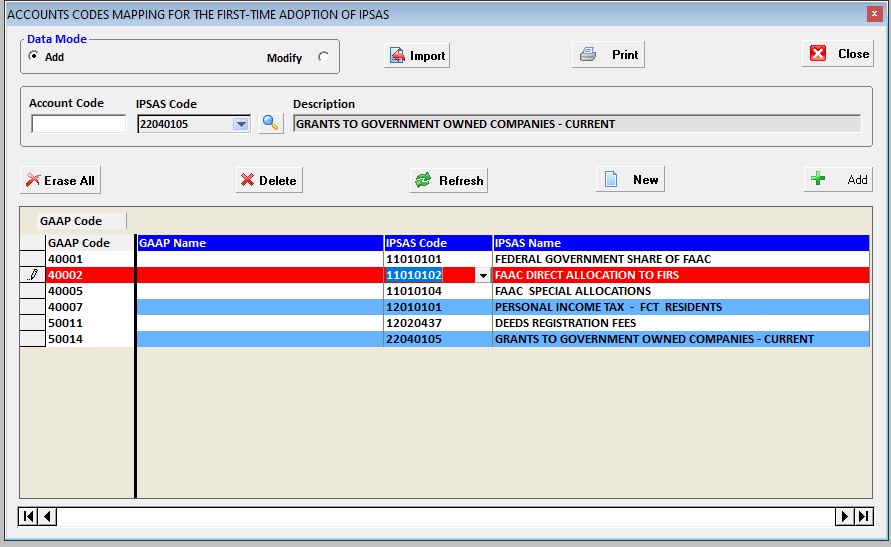

Preparing the transition opening balance based on the previous chart of accounts may not pose a serious challenge. However, the task of mapping each account from the previous accounting system to the IPSAS chart of accounts can be daunting, especially for those who are not entirely familiar with the National IPSAS chart of accounts. Although this mapping can be done manually, the manual method is tedious and prone to errors.

To complete the process, the new IPSAS-compliant system must be updated with the input data from the old system. Again, manual update is tedious and cannot guarantee 100% data accuracy. This is one area where an automated software solution is imperative.

In response to the need to address these challenges, ExpressBook PSA IPSAS-compliant accounting software has provided a special utility called the IPSAS Transition Toolkit to enable a seamless and smooth transition from any environment to the new IPSAS environment.

ExpressBook PSA IPSAS Transition Toolkit is a smart tool meant to perform the following tasks:

- Mapping the previous chart of accounts into the National Chart of Accounts.

- Automatically generating the Closing Balance from the prior year’s transactions.

- Automatically Posting the Closing Balance as IPSAS Transition Opening Balance.

ExpressBook PSA IPSAS Transition Toolkit is also available as a standalone IPSAS conversion utility.

ExpressBook PSA Accounts Codes Mapping Utility for IPSAS Transition Management

Leave a Reply