The Nigerian central government is facing a nightmarish challenge with its budget implementation. For the past two years (2024 and 2025), the Federal Government has been implementing at least two-year budgets concurrently, making proper planning, monitoring and evaluation a nightmare. Although IPSAS 24 allows entities to approve budgets for multiple-year periods and implement them under one budget, implementing two or more-year budgets, appropriated separately, concurrently within the same year, is strange. So, how did Nigeria get here and what is the way out? This article explores the technical and non-technical issues involved in IPSAS Budgeting, Nigeria’s Budget implementation nightmares and the way out, with IPSAS 24 as the framework.

Resolving Practical Implementation Issues and Challenges with Budget Implementation, Management, and Reporting Under IPSAS

PRESENTATION AND MANAGEMENT OF BUDGET UNDER IPSAS

Budget is one of the most important elements of public sector accounting, as it expresses government intentions and plans in financial terms. We can easily gauge the priorities of any government, policy direction and goals by the contents of its budget. People can use the budget as a barometer to measure the sincerity and performance of their governments. For this reason, the budget is the most important document to the people and other stakeholders.

Most public sector budgets are backed up with legislation, making it illegal to spend money outside the provisions of the budget. IPSAS 24 is the Standard that specifies the requirements and guidelines for public sector budgeting and reporting. Unlike IPSAS, IFRS does not have a specific standard for budgeting. Therefore, private sector entities may also learn something that can enhance their budgeting effort and financial planning from IPSAS 24.

IPSAS allows both Cash and Accrual-based Budgeting. Additionally, IPSAS does not make it mandatory for the Budget and Financials to operate on the same basis. That means a situation where Budget operates on a Cash basis while Financials run on an Accrual basis is considered normal under IPSAS. However, there are always reconciliations and reporting challenges with such a system.

Before we examine some of the provisions of IPSAS 24, it is important to understand the difference between Cash- and Accrual-based budgets.

CASH-BASED BUDGET

The cash-based budget specifies cash limits to be spent or expenses to be incurred only against expected cash earnings. Under a Cash-based Budgeting, cash is equal to actual expenditure, and you do not make any commitment until the cash budgeted for the activity is available. Cash-based budgeting is designed to work seamlessly with cash-based IPSAS accounting.

ACCRUAL-BASED BUDGET

The Accrual-based Budget specifies spending limits (not cash limits). It also considers increases in liabilities (or decreases in assets—such as depreciation, inventory write-down, etc.) Because budget figures are spending limits, expenses can be incurred, and commitments made, even when cash is not yet received. An accrual-based Budget is designed to work with an accrual-based IPSAS accounting system. However, it is neither unusual nor strange for a Cash-based Budget and an Accrual IPSAS to run together in the same environment.

In practice, every budget represents cash limits. The significant difference between cash- and accrual-based budgeting is when the expense is recognised. For cash-based budgets, you can only incur and recognise the expense after cash payment, but for accrual-based budgets, you can incur and recognise the expense before payment is made. This makes it mandatory for the accrual-based budget to make provision for Budget Rollover.

Both the cash-and accrual-based budgets require effective monitoring and reporting. In a cash-based budget, you must monitor both the budget limits and the availability of cash before approval, whereas an accrual-based budget only requires monitoring budget limits.

IPSAS 24: PRESENTATION OF BUDGET INFORMATION IN THE FINANCIAL STATEMENTS

IPSAS 24 applies to public entities mandated by law or some authoritative or regulatory instruments to make their approved budgets publicly available. It also applies to entities (such as NGOs, Foundations, etc.) that voluntarily choose to make their budget publicly available for transparency and accountability.

The Standard does not compel entities to make their budgets publicly available nor specify the methods or formats for preparing and presenting those budgets. The power to make the budget publicly available rests with the authority within the budget jurisdictions.

IPSAS 24 specifies the disclosure requirements to be made by the preparers and executors of publicly available budgets, who are to be held accountable for their compliance. The Standard explicitly demands the following disclosures:

- A comparison of the budgeted amounts with the actual, as part of the financial statement or as a separate report

- The difference between the budget and the actual, along with explanatory notes

- If the accounting basis used for the budget is different from that of the financial statement, a reconciliation of the actual amounts on the budget with the figures on the financial statement on the budget basis is required.

IPSAS 24 permits the preparation and presentation of budgets using either a cash or accrual basis. However, it does not make it mandatory for the financial statement and budget to be on the same basis. But where the budget and the financial statement use different accounting bases, disclosure (3) above becomes mandatory. All reconciliations and comparisons must be made on the same basis as the budget.

Original and Final Budgets

IPSAS 24 makes a clear distinction between Original and Final budgets. The original Budget refers to the initial approved budget for the period, while the Final Budget refers to the budget adjusted for changes within the period. Such adjustments include supplementary budgets, internal transfers from one budget head or item to another, and other authorised adjustments. Where these adjustments occur, the entity shall present a report stating whether differences between the original and final budgets are due to internal reallocation or external factors.

BUDGET CLASSIFICATION

Budget classification is an essential requirement for IPSAS budgeting. Classification gives budgets a distinctive structure and provides clarity and transparency. It also meets one of the qualitative characteristics of financial information, namely, understandability. By grouping similar items and ensuring all major and minor components of the budget are accurately represented, the budget will comply with the following sound budgeting principles: Comprehensiveness, Unity, and Internal Consistency. Poorly classified budgets will not only be difficult to understand, but they will also be challenging to implement and monitor.

IPSAS 24 requires the classification of budget items into different headings and sub-headings to enhance the qualitative characteristics of financial statements. But it neither specifies the structure nor the guidelines for classifying budgets. The level of aggregation and format to use is open to domestication by each jurisdiction.

Various classification methods have been adopted by many countries and entities around the world, but generally, the following classification systems are currently in use globally:

Administrative Classification

This classification is based on the organs of government (ministries, departments, and agencies) responsible for managing the funds allocated.

Economic Classification

Economic classification identifies specific line items or groups of items for which budgets are allocated. These correspond to the items in the Economic segment of the National Chart of Accounts.

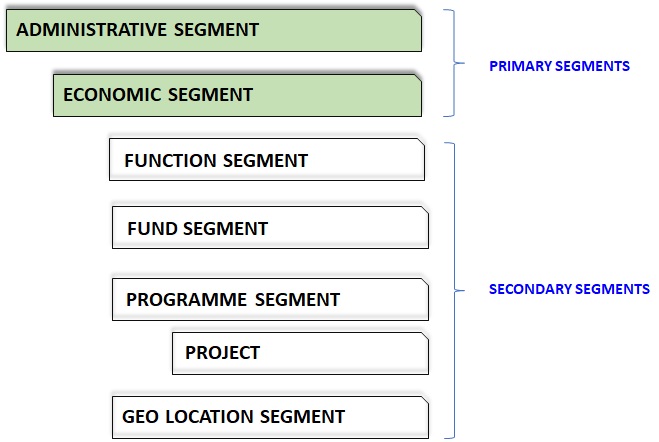

These two classifications can be regarded as the primary segments for classifying budgets. Other segments include Fund, Function, Programme/Project, and Geographic Location segments. We have already discussed these segments under the IPSAS National Chart of Accounts, which comprises these six segments.

BUDGET PREPARATION TEMPLATE

The National chart of accounts provides the following segments for the classification of budgets: Administrative, Economic, Function, Programme, Fund, and Geographic Location. The first two segments—Administrative and Economic—are the Primary Segments, while the other four can be regarded as Secondary Segments. During budget preparation, the secondary segments are attached to the primary segments in a one-to-many relationship.

Although each item of the Economic segment doesn’t need to have an association with all the secondary segments, it is good budgeting practice to associate all the relevant items in the primary segments with the secondary segments. For example, each item of Capital Expenditure must be assigned to both the Programme and Geo Location Codes. This will make it possible to produce the budget and financial reports that show the distribution of capital projects based on geographic locations.

BUDGET REPORTS

Budget Reports comprise Budget Estimates and Budget Performance appraisals, which compare the amount budgeted with the actual. Apart from the standard reports, which focus on the Economic and Administrative segments, reports are also required for the secondary segments, to enable segment analyses of the budget. Getting the actuals for each segment will require linking (or mapping) each segment in the budget into the General Ledger transaction. It is almost impossible to carry out such a task manually. This makes using an automated system mandatory for effective and accurate budget implementation.

PRACTICAL BUDGET IMPLEMENTATION ISSUES AND CHALLENGES

Two important responsibilities are involved in the process of Budgeting, whether in the public or private sector. They are:

- Budget Management: Planning, Preparation, and Review.

- Budget Implementation, Monitoring and Appraisals.

While the first responsibility falls exclusively on the Budget Office, Budget Monitoring and Appraisals should be accessible to all the stakeholders (MDAs and all three arms of government). Each MDA must be able to implement, monitor and appraise its own budget, and produce timely reports. However, those in charge of Budget Management need special tools to enable them to carry out the following essential budget management tasks, among others:

- Collect, Collate and consolidate all the data needed for budgeting. Key parameters to consider in the data collation include MDA Codes, Economic Codes, Fund Codes, Function Codes, Programmed Codes, and Geographic Location Codes.

- Prepare the Proposed/Approved Budget by assigning figures to every line item in the budget, based on approved classification (Administrative, Economic, etc. Each line item must be assigned a code, which must correspond to the Economic Codes in the National Chart of Accounts or approved Budget Codes.

- Collate the Actuals from financial transactions across all MDAs for the budget review and appraisals report.

- Budget Reconciliations are mandatory for reconciling the budgeted items with the actuals, where the budget and financials are on different bases.

- Monitor and evaluate the performance of the Budget in real-time.

- Review the Budget and make officially approved adjustments (such as Supplemental budgeting and Virement or Budget Transfers from one line item to another, and Budget Rollover).

The above can serve as the basic algorithm or process workflow for budgeting, which can be customised to respond to the needs and requirements of any jurisdiction. We cannot accommodate the details of all the procedures that must accompany each of these steps here. However, it is necessary to note the following as prerequisites for an efficient and responsive budget management and reporting system:

- The actual transaction figures from Financials needed for budget evaluation and appraisals lie outside the Budget Office. This data comes from all the MDAs and other public sector entities within the jurisdiction of the central budgeting authority at the Federal, State, or Local Government level. A secure and reliable arrangement or system must be put in place to ensure accurate data capture and collation for reliable and timely budget review and reporting.

- Implementing the above process manually is fraught with errors and delays. The deployment of a custom information management tool that can integrate and automate these tasks in a multi-user and time-sharing environment in real-time is mandatory.

I might dig deeper into some of these later in subsequent posts.

NIGERIA’S MULTIPLE-YEAR CONCURRENT BUDGET IMPLEMENTATION NIGHTMARES

It is not a secret that Nigeria’s Budgets (at both the Federal and State levels) are appropriated on a cash basis, even though Nigeria is almost ten years into implementing Accrual IPSAS. The expenditure codes used by the Budget Office for budgeting belong to the old Cash-based IPSAS Chart of Accounts, some of which no longer exist in the current Accrual IPSAS National Chart of Accounts. For example, all the items that were under CAPITAL EXPENDITURE (Code 23) in the Cash-based Chart of Accounts are now under NON-CURRENT ASSETS (Code 32) in the Accrual IPSAS National Chart of Accounts.

This has presented a challenge, not only for budget management and reporting, but also for accurate monitoring of the budget for Capital Expenditure (now, Noncurrent Assets) by MDAs. We have been able to resolve this challenge in most of our IPSAS implementation projects using our ExpressBook PSA IPSAS-Compliant accounting software, by mapping the Capital Expenditure Codes used for budgeting into Non-Current Assets Economic Codes in the Accrual IPSAS National Chart of Accounts.

However, this is not the biggest challenge the Nigerian Federal Government faces with budget implementation. For the past two years (2024 and 2025), the Federal Government has been implementing at least two-year budgets concurrently, making proper planning, monitoring and evaluation a nightmare. Although IPSAS 24 allows entities to approve budgets for multiple-year periods and implement them under one budget, the implementation of two or more-year budgets, which were appropriated separately, concurrently within the same year, is strange. So, how did Nigeria get here and what is the way out?

Before we can begin to talk about the way out, we must understand how Nigeria got here. There are three major reasons why this is happening:

- Budgets and Financials run on different accounting bases. Although many MDAs in Nigeria are still operating on a Cash basis in practice, Capital expenditures are accounted for on an accrual basis.

- There is no reconciliation between the Cash Budget Codes used by the Budget Office for preparing and presenting the Federal budgets and the Non-Current Assets Economic Codes in the National Chart of Accounts, used by the Office of the Accountant-General of the Federation.

- There are no facilities or automated tools for Budget Rollover.

Budget and Financials can run seamlessly without any serious challenge when both operate using the same accounting basis. However, there are practical implementation issues to address where the Budget is on a Cash basis while the Financials are on an Accrual basis. These are the issues Nigeria has not yet addressed.

Under the environment where Budget and Financials are on the same basis, it is easy to roll over the budget, based on the same principle used for closing the accounting year, which is as follows: At the end of every accounting year, the following takes place:

- All the Revenue and Expenditure items are carried over to the new accounting year with zero balance.

- All Assets and Liabilities are rolled over to the new accounting year, with their Closing Balance at the end of the year, as the Opening Balance for the new accounting year.

However, even in a situation where Budget and Financials operate on a separate basis, the same result can still be achieved if there is an automated Budget Reconciliation system that maps Budget Codes from the Budget system into Economic Codes in the Financial system, to enable Budget Rollover. Effective implementation of such a system will also require a policy on the cut-off date for transactions involving Capital Expenditure, to ensure the timely preparation of budgets and the passage of the Appropriation Bill. In the absence of a real-time reconciliation and budget rollover system, effective real-time budget management and control will be impossible or futile.

Here is the practical scenario under the current Nigerian budgeting system:

- At the beginning of every accounting year, every budget item has a zero entry for the new year (Cash-based Budgeting Rule).

- Non-Current Assets (Capital Expenditure) in the books of MDAs start with the closing balance from the previous year as their opening balance for the new accounting year (Accrual-based Accounting Rule).

We can now see clearly where the two systems are out of sync and the root cause of the problem. In the absence of reconciliation between the systems and a facility for Budget Rollover, the nightmare will continue indefinitely. Under this scenario, the Budget Office may have data, through the government cash collection system, GIFMIS, to reconcile Recurrent Expenditure, but they will not have any idea of what is going on with Assets and Liabilities.

Eliminating these issues and challenges requires deploying automation tools for data harmonisation, real-time reconciliation, hassle-free budget review and reporting. This is the key to efficient and reliable budget management. Our ExpressBook PSA IPSAS-compliant accounting solution has custom tools and utilities to tackle these challenges.

Leave a Reply