Accounting and Business Software Solutions for Small & Medium Enterprises (SMEs)

ABC TOOLKIT

IFRS-compliant accounting and business SOFTWARE solutionS for SMALL & MEDIUM ENTERPRISES (SME).

Complies with IFRS for SME

Ensures your accounts meet international standards seamlessly.

Real-Time Financial Insights

Access up-to-date analytics to drive strategic decisions.

Multi-currency

Multi-currency Bookkeeping and reporting at no extra cost.

User-Friendly Interface

Designed for simplicity to enhance productivity.

Comprehensive Reporting

IFRS-compliant financial statements and standard accounting reports.

VAT Automation

automation of Value-Added Tax (VAT) computaton, accounting, and reporting.

ABC Financial & Business Toolkit is IFRS-compliant accounting software, designed and built for Small and Medium Enterprises (SMEs) at a price they can easily afford.

Apart from the issue of price, the software has been made simple enough to bring accounting to the level of anyone who can read and write, irrespective of whether the person has ever heard of the word “accounting.” This is predicated on our belief that proper accounting ought to be intuitive, since our daily activities revolve around making and spending money.

As simple as the software may be, it is standard accounting software that complies fully with all the relevant provisions of the International Financial Reporting Standards (IFRS). It comes loaded with standard and optional features you may not find in some expensive software.

ABC Toolkit owes its uniqueness and simplicity to the fact that the system design is based only on Income and Expense only unlike the conventional ledger-based accounting software that is modelled after the classical books of accounts. ABC Toolkit has only three principal modules, namely, Cash, Income and Expense—every other thing is packaged either as a special utility or an optional tool. With this model of bookkeeping, people do not need to go to school or spend days learning before they can master the technique of keeping their books using accounting software.

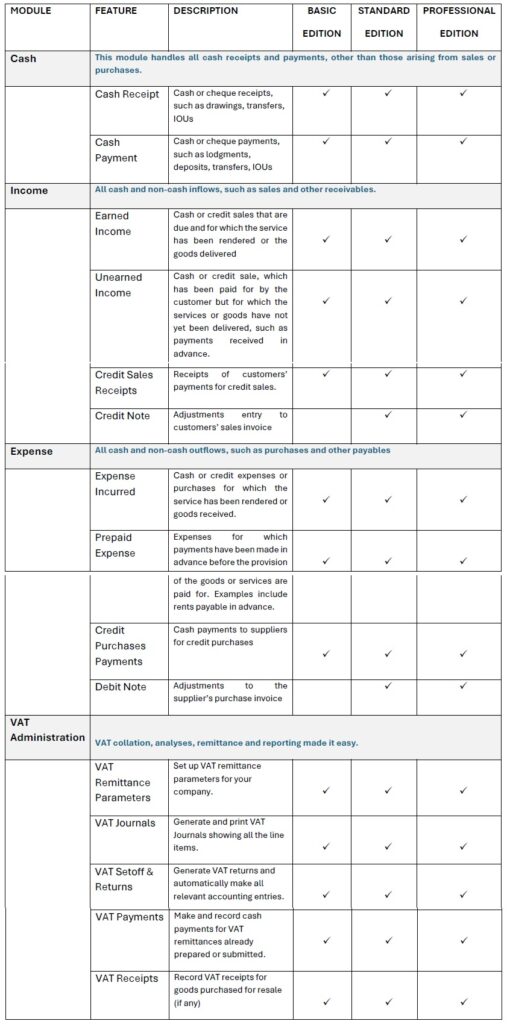

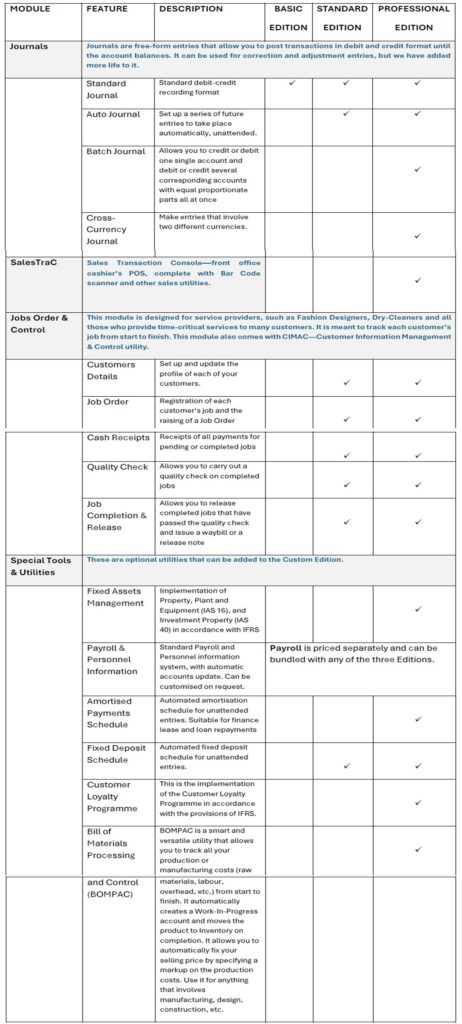

The system comes packaged in the following editions: Basic, Standard, Professional and Custom Editions. While the first three editions contain pre-determined features, the Custom Edition, on the other hand, allows you to add features you need to the standard offering by choosing from the pool of optional tools. It also allows you to specify any other feature you may want built specifically for you.

ABC Toolkit comes preloaded with standard default parameters (including the Chart of Accounts) so that you don’t have to worry about setting up anything before you begin to use the software. All you need is your company’s name.

The system comes with several report options, including IFRS regulatory reports that must meet specific IFRS disclosure requirements. Apart from the regulatory reports, each module of the program carries additional reports relevant to that module. Reports can be exported in various formats.

One important and special feature of the ABC Toolkit is automated VAT (Value-Added Tax) Remittance. We have given Value-Added Tax (VAT) special treatment because of its importance to our economy. The VAT Administration module is a standard feature in all editions of the ABC Toolkit.

An independent study we carried out revealed that 80% of small businesses either do not charge or remit VAT, due to one or all of the following reasons:

- Ignorance of the VAT legislation.

- Lack of a proper accounting and reporting system.

These are part of the reasons we had to put so much into the design and implementation of the VAT module. Standard VAT Controls enable automatic VAT computation and accounting for different types of VAT. A few keystrokes are all that is required to generate and print VAT Returns. Beyond this, there are tools to take care of all the accounting entries associated with VAT remittance.

To enable automatic computation, accounting and reporting, the following standard VAT accounts have been defined:

- VAT Output—Sales

- VAT Input—VAT Paid on Goods

- VAT Taken at Source

- VAT Expense—VAT Paid on Overhead Expenses

All that users need to do during data entry is to select the appropriate VAT option from the list, and all other things will fall into place neatly.

ABC Toolkit is not only an ideal solution for small businesses, but also a recommended personal accounting tool for individuals and families.

ABC Toolkit Standard Features

ABC Toolkit Special and Optional Features

Bespoke and special versions of the ABC Toolkit include:

- ABC BakerMITS (for Bakeries)

- ABC MoneyQuadrant (for Cooperative Societies)

- ABC CareBook (for NGOs)

For urgent enquiries, please call:

09132312209 (Abuja); 0803 402 2629 (Lagos).

Empower Your Business Today

Please take the next step to unlock powerful financial tools tailored for your SME’s growth. Contact us now!