In theory and practice, Cash-based IPSAS accounting may not present a serious bookkeeping challenge because it is based on recognising all inflows as Receipts (Revenue) and outflows as Payments (Expenditure). However, under Accrual IPSAS, where Cash must be accounted for as an asset while Revenue and Expenditures are accounted for separately, there are transition challenges that must be addressed. Although I have addressed some of these challenges in my previous posts, there is yet another crucial implementation challenge that must be addressed before we can account for Cash as an asset. This post addresses these challenges.

There are Custom Practical Implementation Issues to be resolved in setting up the Cashbook for Cash and Accrual-Based IPSAS Accounting.

The function of the Cashbook remains the same, irrespective of whether an entity is implementing Cash or Accrual IPSAS: Recording of direct cash inflows and outflows. The standard accounting entries involved in these transactions are as follows:

- Inflows: Debit Cash and credit the cash Source.

- Outflows: Debit Destination or beneficiary of cash outflow and Credit Cash.

The source of cash can be revenue and receipts from other cash sources, while the destination includes expenditure and cash transfers to other sources. However, there are restrictions on the nature of the source and destination under Accrual IPSAS.

CASHBOOK TRANSACTIONS UNDER ACCRUAL IPSAS

Accrual accounting demands that Expenditure and Revenue must be recognised when they are incurred and earned, independent of when Cash is paid or received. That means under Accrual IPSAS, the destination of Cash cannot be expenditure or cost incurred through third-party procurement of goods or services; it must be the vendors or suppliers of those goods or services. Accrual accounting demands that Expenditures on the procurement of goods and services must first be recognised in the Sales Ledger (Vendors or Accounts Payable).

The recognition of expenditure on goods and services in the Sales Ledger will give rise to the following accounting entries:

- Debit: Expenditure or Assets.

- Credit: Vendor or Supplier.

Payment for those goods and services will result in the following Cashbook entries:

- Debit: Vendor or Supplier.

- Credit: Cash.

- This is the mandatory two-step process involved in Cash payment for goods and services under accrual accounting and Accrual IPSAS.

PRACTICAL IMPLEMENTATION ISSUES

The National Chart of Accounts does not have entries for physical Bank and Cash accounts operated by the various public sector entities. Instead, it provides control accounts, meant for tracking Cash payments and receipts for various categories of expenditure and revenues.

Under CASH AND BANK BALANCES HELD BY MDAS (3102), the following control accounts are available:

- CASH BALANCE: CAPITAL (31020101).

- CASH BALANCE: PERSONNEL (31020102).

- CASH BALANCE: OVERHEAD (31020103).

- CASH BALANCE: REVENUE (31020104).

- CASH BALANCE: AID & GRANTS (31020106).

- CASH BALANCE: LOANS (31020107).

- CASH BALANCE: OTHER FUNDS (31020108).

- LMP CASH BALANCE: FGN STATE-OWNED ENTERPRISES (31020109).

The following accounts are also available under CASH/BANK BALANCES HELD BY AGF (3101).

- OAGF CASH BALANCE: CONSOLIDATED REVENUE FUND (31010101).

- OAGF CASH BALANCE: CONTINGENCY FUND (31010301).

- TSA-ACCOUNT CASH BALANCE (31010501).

These accounts can only serve as a control account to the physical Bank/Cash accounts operated by each public sector entity. This poses a challenge that will make it difficult (or impossible) for each public sector entity to have its Bank/Cash transactions in the General Ledger for detailed reporting.

Resolving this challenge requires setting up a Bank/Cash Sub-Ledger that maps the entity’s physical Bank/Cash accounts into the control accounts in the National Chart of Accounts. Each Bank/Cash account in the Sub-Ledger must be assigned a unique ID or Code that will identify its transactions uniquely in the General Ledger, under the account it is mapped into. This arrangement is a mandatory requirement for proper accounting for and management of cash as an asset, irrespective of whether the entity is implementing cash- or accrual-based IPSAS.

The reason public sector entities in Nigeria, operating Cash-based accounting (including many State governments), are unable to keep back-to-back balanced accounts is due to their inability to account for cash transactions in real-time as an asset. The normal practice is to wait till the end of each accounting period before they can bring in what they call Closing Cash and Bank Balances or Cash/Bank Balances Brought Forward, to balance their books for that year. Implementing this procedure will enable public sector entities to account for cash in real-time as an asset and always have a balance book, irrespective of whether they operate on a cash or an accrual basis. We must understand that implementing Cash-based IPSAS does not preclude a public sector entity from maintaining a balanced account.

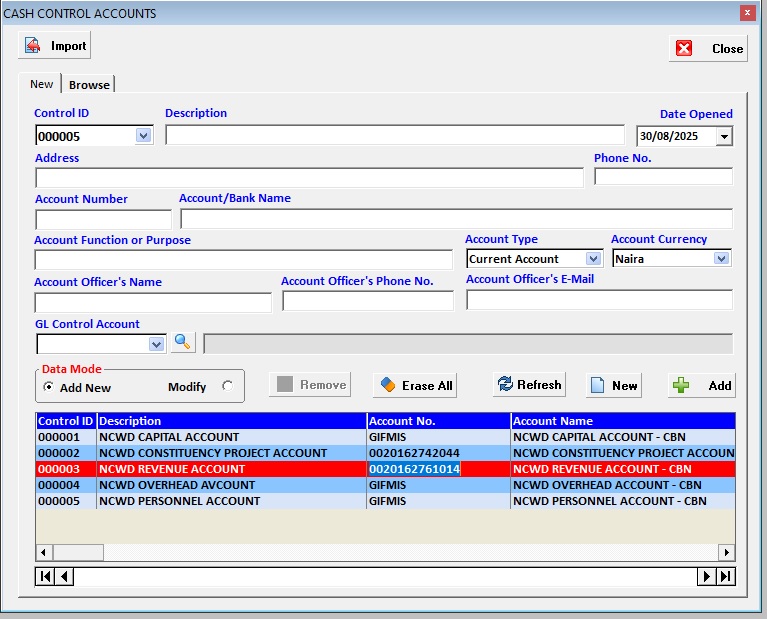

ExpressBook PSA IPSAS-Compliant accounting software has implemented and automated this procedure by providing a Cash/Bank Sub-Ledger Utility that maps each entity’s physical Bank/Cash account to the control account in the National Chart of Accounts. It uses a special auto-generated Bank/Cash Control ID to keep track of each physical Bank/Cash transaction in the General Ledger, making it easy for entities to generate a detailed Cash/Bank Statement and to perform their Bank Reconciliation without stress.

SUPPLEMENT ON CASH-BASED IPSAS

Now, let us examine the full range of issues involved in implementing Cash-based IPSAS.

IMPLEMENTING CASH-BASED IPSAS

The International Public Sector Accounting Standards Board (IPSASB) have issued 50 individual standards (as of July 2025), comprising 49 Standards (numbered IPSAS 1–49) for Accrual IPSAS accounting and one unnumbered Standard, titled Financial Reporting Under the Cash Basis of Accounting, for Cash-based IPSAS accounting. Entities not ready to adopt the accrual-based IPSAS are permitted to adopt only the cash-based Standard and migrate to the complete accrual Standards later.

The IPSAS Standard for Cash-based accounting, Financial Reporting Under the Cash Basis of Accounting, essentially deals with the disclosure and presentation of sources and uses of Cash. It prescribes “the manner in which general purpose financial statements should be presented under the cash basis of accounting.”

The cash-based IPSAS comprises two parts: Part 1 deals with the Mandatory Disclosures for reporting under the cash basis accounting, while Part 2 deals with Encouraged Disclosure requirements. Each public sector entity implementing IPSAS is expected to comply fully with all the provisions of Part 1. Otherwise, the entity cannot claim to have complied with IPSAS. Although the provisions of Part 2 are not mandatory, each public sector entity is encouraged to comply with them.

The most important item under mandatory disclosure is the preparation and presentation of general-purpose financial statements, which comprise the following:

- A Statement of cash receipts and payments.

- Accounting policies and explanatory notes to the financial statements.

- Budget estimates and comparisons, either as a separate report or as a column in the Statement of Cash Receipts and Payments.

The Standard also requires mandatory disclosure of cash receipts and payments controlled/settled by:

- The entity.

- Other government entities and

- External third-party.

Nigeria transitioned from cash-based IPSAS to full accrual standards in 2016. However, the realities on the ground indicate that many public sector entities, both at the Federal and State levels, have yet to meet the accrual Standards requirements.

Although the cash-based Standard deals with cash receipts and payments, entities are also required to disclose information about non-cash assets and liabilities, such as payables and borrowings, receivables, investments, property, plants, and equipment, etc., in their notes to the financial statements. Therefore, proper implementation of the cash-based standard also involves accounting for assets and liabilities on the sidelines, in addition to income and expenditure. Contrary to these requirements, many public sector entities implementing the cash-based IPSAS have jettisoned even the most basic accounting requirements for assets and liabilities in their daily bookkeeping entries.

Receipts and payments involve cash, and cash must be accounted for as an asset, along with income and expenditure. Third-party deductions are liabilities that must also be accounted for under cash-based accounting. Most public sector entities keep daily records of income and expenditure and wait till the end of the quarter or year before they bring in the cash and bank balances. The result is incomplete records, where the account is perennially out of balance. Three months into the new accounting year, some State governments will still be waiting to receive entries that will balance their accounts for the previous year because of Incomplete Records bookkeeping practice.

The inability to account for assets and liabilities is due to two factors:

- Partial adoption of the National Chart of Accounts, which limits the chart of accounts to revenue and expenditure codes only.

- Reliance on manual or semi-manual accounting methods.

Whether an entity is implementing the cash or accrual-based IPSAS, it is recommended that the full accrual-based chart of accounts be used. Since the chart of accounts has already been prepared, there is no excuse or justification for not adopting it. The National Chart of Accounts has been prepared to cover all three tiers of government. Even if an entity decides to modify the chart to suit its cash-based operation, it should retain all the items under the Assets and Liabilities section.

The issue of manual bookkeeping is a sad testimony to the unwillingness of our public sector entities to embrace modern tools meant to improve their efficiency and productivity. Any entity still relying on manual bookkeeping is hampering the progress of the system.

You must understand that implementing Cash-based IPSAS does not exempt you from complying with the measurement and recognition policies of IPSAS. Cash-based IPSAS is more about the preparation and presentation of financial statements. In recognising Revenue and Expenditure, it will also be necessary to recognise all associated assets and liabilities, enabling you to maintain a balanced account that is in line with the Double-Entry Principle.

ACCOUNTING FOR CASH AS AN ASSET UNDER THE CASH-BASED ACCOUNTING SYSTEM

Under the cash-based accounting system, cash is the primary instrument in recognition of Income and Expenditure. Entities are more concerned with recording income and expenditure (receipts and payments), while the cash part of the transaction is deferred or kept separately from the transactions. This is due to a lack of enforcement of the double-entry accounting requirement for each transaction.

Failure to account for cash, along with recognition of income and expenditure, could create room for heuristic measurement of cash, which can easily lead to errors and fraud. Therefore, it is imperative to recognise cash simultaneously with receipts and payments by adopting the following accounting treatments.

Cash Receipt

In most public sector entities, cash comes from two primary sources:

- Revenue from Exchange/Non-Exchange transactions

- Cash transfers from other sources or loans

Whenever cash is received, the source of the cash (where the money is coming from or the economic item which generates the money) must be credited, and the destination (where the cash flows into) must be debited. The source could be cash/bank, revenue, or creditor accounts, but the destination is often the bank account.

On the receipt of cash, the following simple and obvious accounting entries must be made:

- Dr. Cash/Bank (Destination).

- Cr. Revenue (or Source of Cash).

This simple accounting entry meets the double-entry requirements for the recognition of revenue. However, it is impossible to make this entry where the chart of accounts does not contain the assets group.

Cash Payment

Cash is often paid for the purchase of goods and services. Under cash-based accounting, all transactions are paid for in cash. Liabilities or commitments arising from credit purchases are not recognised. However, IPSAS requires the disclosure of such liabilities in the Notes to the financial statements.

The accounting entries for cash payments are as follows:

- Dr. Expenditure

- Cr. Cash

This satisfies the double-entry requirement for the recognition of expenditure. However, it requires the presence of the cash account (asset) in the chart of accounts.

ACCOUNTING FOR ASSETS & LIABILITIES UNDER CASH-BASED IPSAS

Assets

Assets can be classified into two categories: Current and Non-current assets. Cash and Receivables are examples of Current Assets, while Property, Plant, and Equipment are examples of Non-current assets. Since Receipt and Payment involve cash, we must always account for cash along with income and expenditure. While it may not be possible to account directly for non-cash assets under cash-based accounting, IPSAS requires their disclosure as Notes to the financial statements.

To compensate for the non-recognition of non-cash assets, cash-based expenditure is classified into Recurrent and Capital Expenditures. This makes it possible to report non-current assets as Capital Expenditure under the cash-based IPSAS.

Liabilities

Liabilities are the entity’s commitments to third parties. However, under cash-based accounting, liabilities are not recognised along with cash payments. That means expenses incurred through third parties’ engagements are not recognised until payment is made. Although you cannot directly recognise liabilities under cash-based accounting, IPSAS requires their full disclosure as Notes to the financial statements.

Our ExpressBook PSA IPSAS-Compliant Accounting Software is built and configured to implement both Accrual and Cash-based IPSAS simultaneously.

Leave a Reply