…Also Features the Consolidation Under Treasury Single Accounts (TSA)

Preparing the consolidated accounts based on input from various government ministries, agencies, and departments (MDAs) is one of the high points of IPSAS accounting. The process involves disbursing monies to MDAs and getting prompt and accurate returns from them on how the money was spent. Based on the provisions of IPSAS 18, MDAs are expected to function as Operating Segments, with each MDA preparing its independent financial statements, in addition to the consolidated financial statements prepared by the central government. That also means their returns to the central government must include outstanding liabilities (payables) and assets (receivables)—not Receipts and Payments only. However, under the present realities, where most MDAs are operating on a cash basis, they are unable to comply with IPSAS 18 requirements. This post addresses the accounting and practical implementation issues and challenges involved in preparing the consolidated accounts under IPSAS and how to get around them.

Consolidating accounting entries from the various government Ministries, Departments, and Agencies (MDAs) is one of the crucial aspects of public sector accounting. Usually, budgets are centrally administered, and funds are disbursed into the various MDAs based on the provisions of the budget. Each MDA is expected to make returns on all the money it has received (or earns through sales) and the money it has spent. It is, therefore, necessary to have consistent accounting procedures for public sector entities operating centralised accounting systems.

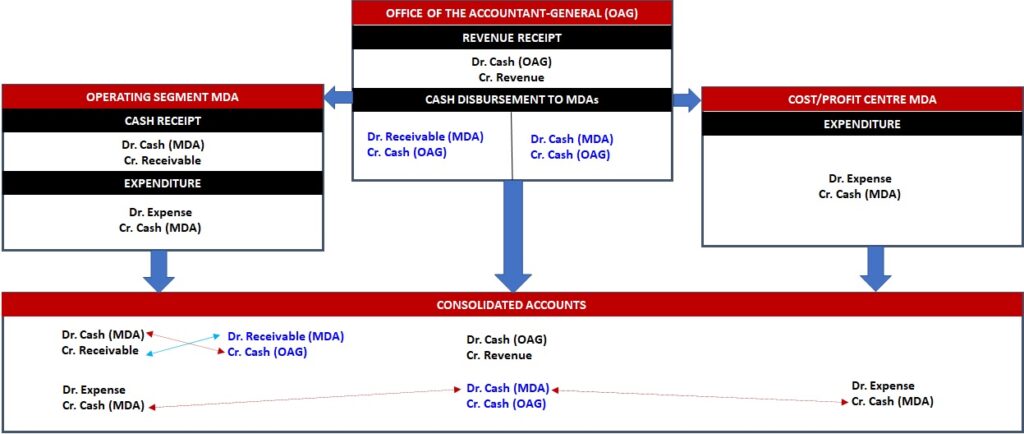

CASH DISBURSEMENT TO MDAs

Before disbursement, the relevant organ of the central government—usually the Office of the Accountant-General (OAG)—must recognise the receipt of cash from its revenue source by making the following accounting entries:

- Debit: Cash (OAG)

- Credit: Revenue

The disbursement to MDAs is based on the available cash.

Classifying MDAs as Cost/Profit Centres and Operating Segments

The accounting entries that must accompany the cash disbursement to each MDA will depend on the operating financial status of the MDA. If an MDA is not expected to produce its own complete independent financial statements (in addition to the consolidated accounts from the Office of the Accountant-General), the operating status of such an MDA is like a COST/PROFIT CENTRE; otherwise, the MDA should be classified as an OPERATING SEGMENT.

Both the IFRS and IPSAS require all Operating Segments to produce their independent financial statements. However, Cost/Profit Centres are viewed as sub-units of the accounting entity, and are, therefore, not expected to produce their own independent financial statement, other than Receipts and Payments (Income and Expense) report.

An MDA that functions as a Cost/Profit Centre will only make Receipt and Payment (Income and Expenditure) returns to the central government. However, all Operating Segment MDAs are expected to make full returns, which must include assets and liabilities, to the central government for consolidated financial reporting. Although IPSAS has no provision for Cost/Profit Centres accounting, implementing this concept in IPSAS will streamline the accounting procedures between the central government and its various agencies, especially where the full implementation of accrual IPSAS is not enforced.

But we must understand that, based on IPSAS 18 provisions, all the agencies and sub-organisations of the central government are expected to produce their independent financial statements, in addition to the consolidated financial statements of the central government. This makes it mandatory for all MDAs to function as Operating Segments. However, my field experience while implementing IPSAS in Nigeria shows that only Federal MDAs are currently functioning as Operating Segments. Most MDAs at the state level operate as Cost/Profit Centres because they have yet to implement accrual IPSAS at the MDA level. Fundamentally, all MDAs operating on a cash basis can only function as Cost/Profit Centres.

The following accounting entries apply to the disbursement of cash from the Office of the Accountant-General to the various MDAs, based on their operating status:

Disbursement to Cost/Profit Centre MDA

- Debit: Cash (MDA)

- Credit: Cash (OAG)

Disbursement to Operating Segment MDA

- Debit: Receivable (MDA)*

- Credit: Cash (OAG)

In the first case, the cash is disbursed directly into the MDA’s bank account as Imprest, while the disbursed cash is treated as Receivables in the case of Operating Segment MDAs.

* NOTE: The reason for the use of Receivable accounts for Operating Segment MDAs is that the money given to those MDAs is regarded as Administrative Advances, which must be retired. However, retirement will come in the form of expenditure after acknowledging receipt of the money in their books.

RETURNS FROM MDA’s

Upon receipt of its cash allocation, each MDA is expected to spend the money and make returns to the Office of the Accountant-General. The book entries required by each MDA’s ledger depend on the operating status of the MDA.

Cost/Profit Centre MDAs

Cost/Profit Centre MDAs do not need to recognise the cash allocated to them in their books because that recognition had already taken place in the consolidated books when the money was transferred to their accounts. Since the cash is already in their respective bank accounts, all they need to do is spend the money and recognise the expense as follows:

- Debit: Expense

- Credit: Cash

Operating Segment MDAs

Each Operating Segment MDA must, first, recognise the cash allocated to it by making the following accounting entries:

- Debit: Cash (MDA)

- Credit: Receivable (MDA)

Next, the MDA must recognise each expense incurred, against the money received, with the following accounting entries:

- Debit: Expense

- Credit: Cash (MDA) – To offset the money allocated to them.

After making their returns to the consolidated account, the credit entries on the cash account will offset the amount disbursed to each MDA, while the debit entries will represent the expenditures.

However, where the MDA functions as an Operating Segment, operating on an accrual basis, the credit entries can also include liability to suppliers and other payables, while the debit side will also include independent revenue earned by the MDA.

The following schematic illustrates the above procedures:

INTER-MDA CASH TRANSFERS

The same policy is also applicable to inter-MDA cash transfers. The source (MDA where the money originates) should make both the credit and debit entries: Debit the MDA receiving the money and credit the MDA giving the money. That means, if the receiving MDA is operating as a Cost/Profit Centre, it does not need to make any accounting entries for the receipt of the money. However, an Operating Segment MDA must acknowledge receipt of the money by debiting its cash account.

ACCOUNTING FOR INTERNALLY GENERATED REVENUE (IGR)

Accounting for Revenue at the Federal government level requires paying or remitting cash directly into the Treasury Single Account (TSA), using one of the existing revenue codes defined in the system. This transaction will result in a debit entry to the Cash account and a credit entry to the Revenue account of the central government. There is no intermediate stage for secondary cash remittance/transfer or revenue returns statement.

GIFMIS (Government Integrated Financial Management Information System) makes this seamless transaction possible. GIFMIS is not accounting software; it is a cash collection and revenue collation system, configured to work with the Nigerian Federal government’s Treasury Single Account (TSA). However, the situation at the State government level is neither seamless nor straightforward. There are grey areas that need to be clearly understood.

The Board of Internal Revenue (BIR) is the agency mandated to collect revenue for each State government. Most of the revenues collected by BIR are those generated through Non-Exchange transactions. Other MDAs may also generate revenues or collect cash from Exchange or Non-Exchange transactions, outside those captured by BIR. However, revenues generated by other MDAs must be remitted to the BIR. The BIR must forward the returns from all revenues to the Accountant-General’s office for inclusion in the consolidated account. This makes it possible for revenue to be recognised only once by BIR. This also means other revenue-generating or cash-collection MDAs cannot recognise revenue in their books.

The Difference Between Revenue and Cash

A clear distinction should be made between Revenue and Cash. Although under Cash-based accounting, Revenue is equal to Cash. The returns made by MDAs to BIR comprise the items generating the revenue. The destination of Cash is a matter of government policy. There is no issue to resolve where there is a central account for the remittance of all cash collections. But when MDAs generate the revenue and remit the money, the cash remittance and revenue returns must be made separately.

The Difference Between Cash Remittance and Revenue Returns

There is a difference between Revenue Returns and Cash Remittance. Generally, when revenue is generated, two things happen: The Cash account is debited, while the Revenue account is credited. Revenue Returns involves making returns based on each item of the revenue account that generated the cash, while Cash Remittance involves remitting the cash collected from the revenue transactions. The two events should be treated and recorded as separate transactions in the books.

ACCOUNTING FOR REVENUE COLLECTED BY BIR

BIR is the central authority for the recognition of all revenues. These include the revenues the Board collects directly and those generated or collected by other MDAs. For the revenue collected directly by BIR, the following accounting entries are required:

- Debit: Cash

- Credit: Revenue

This is the final status of revenue collected directly by BIR. The cash part is not our primary concern here.

ACCOUNTING FOR REVENUE COLLECTED OR GENERATED BY MDAs

Apart from BIR, other MDAs may generate revenue and collect the cash resulting from it. However, at the end of the month, returns for all the revenue generated must be made to the Board of Internal Revenue (BIR). The two-part transactions are as follows:

Revenue Generated By MDA

- Debit: Cash (MDA)

- Credit: Unremitted Collections (or Deductions)

Note that only BIR can recognise revenue. Hence, money collected by other MDAs should be recognised as Unremitted Collections—a liability to be cleared later. The LIABILITY account group, UNREMITTED DEDUCTIONS (4103), in the National Chart of Accounts, contains a list of accounts that can be used for this purpose.

Revenue Returns to BIR

Returns for all revenues generated must be made to BIR with the following accounting entries:

- Debit: Unremitted Collections

- Credit: Revenue

This will now clear the liability held by MDAs, leading to the recognition of Revenue. It will be the responsibility of BIR to forward the returns to the Office of the Accountant-General for inclusion in the consolidated account.

Cash Remittance

Where the cash collected is also remitted, this must be carried out as a separate transaction, which involves crediting one bank (the source) and debiting another (the destination). These cash entries have no effect on the revenue.

THE NET EFFECT

With these accounting treatments, both the consolidated accounts and the accounts for each MDA will always have a zero balance. There is no condition under which one should expect or have a non-zero balance, either in the books of the MDAs or the consolidated books.

I must point out that these accounting treatments require the use of Cash/Bank sub-ledgers that map into control accounts under the Cash/Bank Balances (accounts 3101 and 3102) in the National Chart of Accounts. This is a mandatory requirement because there are no entries for individual bank or cash accounts in the IPSAS National Chart of Accounts. How to set up Cash/Bank Sub-ledgers will be the focus of my next post.

Meanwhile, it is good to know that our ExpressBook PSA IPSAS-Compliant accounting software has automated this procedure to make its implementation seamless and hassle-free.

Consistent and accurate implementation of these procedures requires planning and documentation, and the executive’s willingness to enforce compliance with laid-down rules and procedures. No accounting solution will compensate for the lack of discipline and the refusal to adhere to accounting rules.

Leave a Reply