Although both IFRS and IPSAS have provided the relevant implementation guidelines under the First-Time Adoption of the standards (IFRS 1 and IPSAS 33), these guidelines are not far-reaching enough to address local issues and challenges associated with their implementation. That is why each jurisdiction must develop a custom framework for implementing these standards. The steps I have outlined in this article are based on my field experience while implementing IFRS and IPSAS in Lagos and Abuja, Nigeria. This is a hero title that Welcomes to website

The International Public Sector Accounting Standards (IPSAS) and the International Financial Reporting Standards (IFRS) are the two international standards that prescribe uniform criteria for accounting measurements and reporting. These standards are not rule-based—they are policy-based. Both standards formulate accounting policies on how accounting rules should be applied. While the IFRS are designed for the private sector profit-making entities, IPSAS are meant for public sector entities.

These two Standards do not prescribe any new rules, principles, or methods that overwrite the fundamental principles and methods that govern accounting. Rather, they prescribe a uniform criterion on how accounting methods and rules must be applied uniformly and consistently, and how financial reports should be presented.

The fundamental rule or law that governs accounting is the Double-Entry Principle, which states: For any given financial transaction, the sum of all debit entries must be equal to the sum of all credit entries, or vice versa. This law provides the sacred foundation upon which modern accounting sits, and both the IPSAS and IFRS are constructed on this foundation.

The following primary methods (or tasks) provide the empirical template for accounting:

- Classification

- Recognition

- Measurements

- Presentation

IPSAS and IFRS are designed to regulate these accounting methods by imposing boundaries and conditions on how entities apply these methods in their financial transactions, through their accounting policies.

Although the International Public Sector Accounting Standards Board (IPSASB), the body that administers IPSAS, allows each jurisdiction to domesticate the Classification and Presentation methods to suit national requirements, all domestication must align with the IPSAS conceptual framework. The IPSAS National Chart of Accounts and the General-Purpose Financial Statements (GPFS) are the primary deliverables from IPSAS domestication.

How do IPSAS and IFRS standards enforce strict adherence to the fundamental laws and principles of accounting? They do this by relying on their Conceptual Framework. The Conceptual Framework provides a template for every standard they promulgate. This framework ensures that all standards issued are consistent with the rules and principles of accounting. Similarly, for us to implement these standards successfully, an implementation framework to guide us through the process is mandatory. Such a framework will help ensure that nothing is left out or broken, knowingly or unknowingly.

Although both IFRS and IPSAS have provided the relevant implementation guidelines under the First-Time Adoption of the standards (IFRS 1 and IPSAS 33), these guidelines are not far-reaching enough to address local issues and challenges associated with their implementation. That is why each jurisdiction must develop a custom framework for implementing these standards. The steps I have outlined in this article are based on my field experience while implementing IFRS and IPSAS in Lagos and Abuja, Nigeria.

IPSAS IMPLEMENTATION FRAMEWORK

What do we mean by IPSAS Implementation? Literally, “implementation” means “accomplishing some aim or executing an order.” However, in the context of this subject, I will define implementation more broadly and technically as the act of turning a conceptual model into a practical solution. All the IPSAS and IFRS standards are based on a common conceptual accounting framework. Implementation means turning this framework into a physical, practical system or solution.

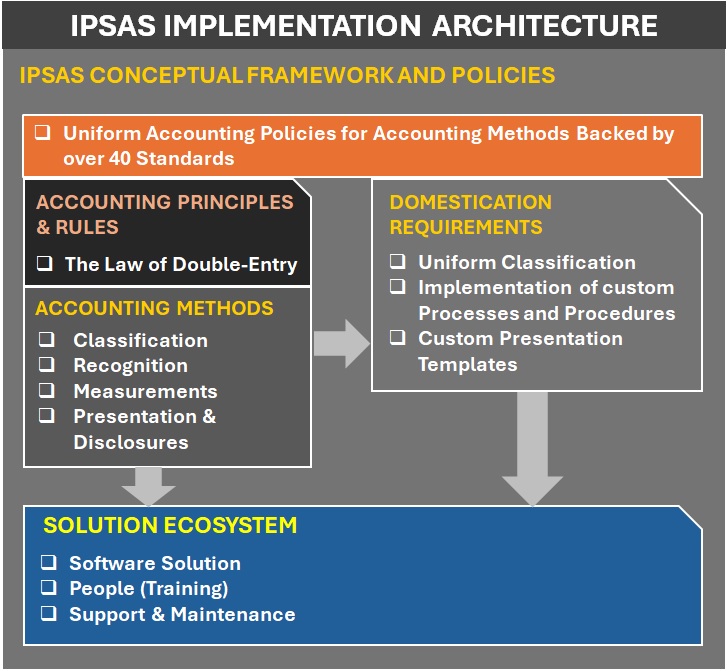

IPSAS implementation architecture or framework comprises the following key components:

- Accounting Rules and Methods.

- IPSAS Standards and Policies.

- Domestication of IPSAS.

- Transition Management (for the First-Time Adoption of IPSAS).

- Solution Ecosystem

- People

IPSAS implementation involves harnessing these components seamlessly to provide a practical solution that addresses the issues at stake to produce the right results.

Accounting Rules and Methods Vs IPSAS Policies

Accounting Rules and IPSAS policies work in tandem with each other. IPSAS does not change the fundamental laws or principles and methods of accounting; it merely prescribes uniform criteria for applying these laws and methods. The rules governing debit and credit remain the same and valid all the time, based on the Double-entry Principle, but IPSAS regulates how and when these rules and methods should be applied. IPSAS provides a meta-layer for accounting rules and methods, with IPSAS policies providing an interface between IPSAS and accounting methods.

For example, the standard accounting rule requires the recognition of revenue when we sell a product. However, IPSAS prescribes the timing for the recognition of revenue earned. According to the IPSAS (and IFRS) Revenue Recognition policy, you can only recognise revenue when the product has been delivered to the buyer and after all legal requirements for ownership of the product have been transferred to the buyer. This prevents the entity from recognising revenue from goods yet to be delivered, even if they have received payment for such goods, thereby creating a dichotomy between Earned Revenue and Unearned Revenue.

This is a typical example of how IPSAS policies interface with and regulate the accounting rules and methods of Recognition and Measurement. Basically, IPSAS (and IFRS) Standards are primarily concerned with prescribing accounting policies for the Recognition and Measurement of Income, Expenses, Assets, and Liabilities. Therefore, IPSAS implementation involves providing a practical system that complies with and enforces all standard accounting rules and IPSAS policies. This makes IPSAS and IFRS the ombudsman of accounting practice.

Domestication of IPSAS

As a principle-based standard, IPSAS allows each jurisdiction to domesticate the Classification and Presentation methods according to its preferences. However, domestication neither changes the rules of accounting nor the requirements and provisions of IPSAS policies.

Domestication involves creating a custom uniform template, based on IPSAS policies, for all entities within a given jurisdiction. The National Chart of Accounts and the provision of a uniform template for General-Purpose Financial Statements for the three tiers of government are products of domestication. Accounting policies for statutory provisions, such as taxes, are also on the list of items to be domesticated. You will find details of all these in the National Accounting Manual, produced by the Office of the Accountant-General of the Federation.

Transition Management

Transition management for the First-Time Adoption of IPSAS is one important task of IPSAS implementation. However, many people tend to ignore or take this task for granted, only to get stuck somewhere along the way because of the failure to prepare in advance. Transition management involves orderly migration of financial data from a non-IPSAS-compliant legacy system (be it manual or automated) to an IPSAS-compliant system. IPSAS 33 is the Standard that specifies the requirements for the First-time Adoption of accrual IPSAS. I will cover this topic in detail in a subsequent post.

Solution Ecosystem

By solution ecosystem, I mean the algorithm, solution method (whether manual or digital), resources, and the people that support and drive the IPSAS infrastructure to produce the expected results. This encompasses everything within the environment that supports the IPSAS meta-system and infrastructure. If something goes wrong with the environment that supports the system, it can sabotage the process and cause the project to fail. The health and readiness of the solution ecosystem are what determine the overall success or failure of the IPSAS implementation task.

Let me quickly emphasise here that IPSAS is not meant to be implemented manually and cannot be implemented manually. Apart from the enormous amount of data involved and the complexity of the requirements, the manual accounting method cannot even meet basic bookkeeping requirements for accrual accounting.

Manual accounting is an outdated method of accounting that has no place in the IPSAS implementation architecture. Sadly, many highly placed people in the public sector benefit so much from the chaos and opacity of manual accounting that they are doing everything possible to oppose the adoption and implementation of IPSAS in their organisations or agencies.

Make no mistake about this! The set of accounting rules and policies required for a uniform application under IPSAS must be automated to enable consistent application and compliance across all public sector entities within a given jurisdiction. This requires the deployment of a bespoke software solution that implements IPSAS based on the national domestication template.

When we talk of a software solution, it should be clear that this refers to IPSAS-compliant accounting software. You must understand that although all accounting software applications are built around a set of standard accounting principles and rules, you cannot find any off-the-shelf software that complies with IPSAS. Before you commit to any software, here are the basic questions you must ask and be sure you get the right answer:

- Does the software comply with and automate the IPSAS Measurement policy (in such an area as Non-current assets)?

- Can the software implement all national domestication policies and requirements?

- Can the software provide a custom template for data import?

A verifiable “Yes” answer to these two questions is mandatory for any software to be considered IPSAS-compliant, no matter how fantastic its features might be. I have seen a situation where people have deployed accounting software that made their work even more cumbersome and expensive than manual accounting. Imagine what could happen if you were to manually input the National Chart of Accounts into accounting software or manually generate the General-Purpose Financial Statements?

ExpressBook PSA is an IPSAS-compliant accounting software solution that was intentionally designed and meticulously built to address all these issues for IPSAS implementation in Nigeria.

IPSAS implementation at the software sub-level should be broken down into the following top-layered application modules:

- Transition Opening Balance

- Financials

- Budgets

- Non-current (Fixed Assets)

- Inventory

Each of these top modules has submodules I will examine in detail in subsequent posts.

While the Transition Opening Balance, Financials, and Budgets can be implemented together, Non-current Assets and Inventory should be phased to commence after the Financials and Budgets modules have been implemented and embedded in the system. It is better to allocate sufficient time for the collation of the various items for the Non-current assets and Inventory and input them after the system is stable and users are adapted to the new environment. Trying to force everything through at once can make the task too cumbersome and error-prone, due to inadequate human capacity to sustain the implementation. That is why a 3-year implementation plan is recommended for accrual IPSAS.

People

People, as one of the most important aspects of the solution ecosystem, require special emphasis. Sometimes, we tend to forget that every solution is meant for the people—to solve their problems and make things better—and for their use. If those who will operate the system are not carried along in the implementation process, then whatever solution that is put in place will be dead on arrival.

The overall aim of implementation is to provide a practical solution that people can use to solve their problems. If at the end of the day, the people such a system is meant for cannot use it effectively and productively, then the entire exercise is a failure, no matter how sophisticated or elegant it might be. Many systems have failed not because of software or hardware inadequacies, but because of users’ inadequacies. Your system cannot be truly IPSAS-compliant until the people running the system are IPSAS-compliant. Training and support should be budgeted for as an ongoing project, even after the full implementation has been completed.

WHAT DOES IPSAS COMPLIANCE MEAN?

What does compliance with IPSAS mean? I asked a senior employee in one of the government agencies in Nigeria whether their accounting system was IPSAS compliant, and his answer was, “Yes.” When I later investigated, I discovered his understanding of IPSAS compliance was limited to having attended training on IPSAS and deploying QuickBooks or Sage. None of the staff of the Finance department knew anything about the National Chart of Accounts.

IPSAS compliance means you have put in place a system that implements the following:

- General accounting rules and policies.

- IPSAS accounting recognition and measurements policies for revenues, expenditures, assets, and liabilities.

- National domestication requirements and policies.

If you miss out on any of these three, you cannot claim to have complied with IPSAS. However, this is only the first level of compliance.

IPSAS standards are dynamic, and they are being updated often as the need arises, based on global financial accounting and reporting requirements. Even the domestication requirements are subject to regular updates. The Nigerian National Chart of Accounts has been updated at least once since its release in 2015. All these demand putting a reliable support and a maintenance system in place, to ensure an immediate response to any change. You may be IPSAS-compliant this year, but fail in subsequent years if you cannot bring your system up to date with relevant updates. In a place like Nigeria, where accrual accounting has been an alien to the public sector since the country’s independence, and where over 75% of public sector entities still engage in manual or semi-manual accounting, embedding IPSAS in the system will require more than procuring hardware and software and embarking on training jamborees. It will require faithful commitment to the process, a high level of professionalism, and depoliticisation of everything that has to do with IPSAS implementation.

Leave a Reply