IMPLEMENTING IPSAS WITH EXPRESSBOOK PSA

About IPSAS

Accounting in the public sector is governed by the global standard, known as the International Public Sector Standards (IPSAS), administered by the International Public Sector Accounting Board (IPSAB)—an independent standard-setting body established by the International Federation of Accountants (IFAC).

TIPSAS is a set of global accounting standards which prescribe the criteria for the classification, measurement, recognition, and presentation of financial information for public sector entities. The primary objective of IPSAB is the development of high-quality global standards for the accounting treatment and presentation of financial information in the public sector to serve the interest of the public. In developing these standards, IPSAB aims to improve the quality of public sector financial reporting and provide the basis for consistency and comparability of the financial information presented by public sector entities.

As of 2024, over 80 countries have either fully or partially adopted IPSAS, and Nigeria and Ghana are two of those countries that have adopted IPSAS as the de facto accounting standard for all three tiers of government in the country.

Domestication of IPSAS

While IPSAS measurement and recognition criteria remain the same for all jurisdictions, the classification and presentation templates are subject to domestication, to suit the national needs and requirements of each jurisdiction. Therefore, the following aspects of IPSAS are subject to national domestication:

- The Chart of Accounts Format and Template

- Financial Statements, Budget Reporting & Disclosures Format and Template.

Domestication makes it impossible to find an off-the-shelf IPSAS-compliant software solution that can meet the needs and requirements of all countries uniformly.

Nigeria’s IPSAS Domestication Requirements

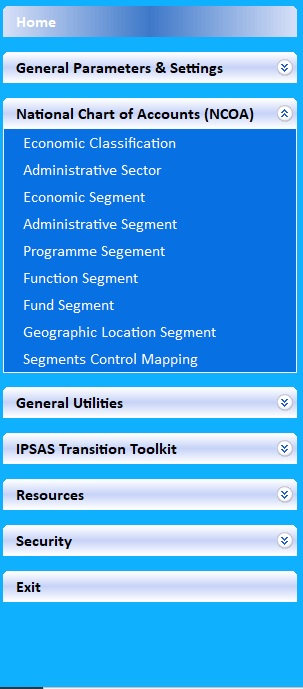

The domestication of IPSAS for Nigeria’s public sector was handled by the subcommittee set up by the Federal Account Allocation Committee (FAAC). Their effort resulted in the release of the National Chart of Accounts, which comprises the following segments:

- Economic Segment (for all three tiers of the public sector)

- Administrative Segment

- Fund Segment

- Function Segment

- Programme Segment

- Geographic Location Segment

The Sub-committee also released the reporting templates for the General-Purpose Financial Statements (GPFS).

To satisfy IPSAS’ requirement for uniform classification and reporting, each of the three tiers of government and all its agencies were expected to comply with the National Chart of Accounts and the financial reporting templates in their various implementations. However, in the absence of a regulatory body to monitor and enforce compliance, it is difficult to imagine anything but complacency or chaos.

EXPRESSBOOK PSA IPSAS-COMPLIANT ACCOUNTING SOFTWARE SOLUTION

ExpressBook PSA is an IPSAS-compliant Accounting Software Customised to Implement IPSAS based on Nigeria’s Domestic Requirements…

INTRODUCING EXPRESSBOOK PSA ACCOUNTING SOLUTION FOR PUBLIC SECTOR ENTITIES

After a thorough examination of IPSAS’ accounting policies and Nigeria’s domestication requirements, the need for a bespoke software solution for the implementation of IPSAS became imperative and urgent. None of the existing conventional accounting software had the capability or features to implement all these local custom requirements, resulting from the domestication of IPSAS.

Emerging from a solid field experience in the implementation of the International Financial Reporting Standards (IFRS), it was not a difficult challenge for us to come out with a quick but reliable solution. We had to adapt our successful IFRS-compliant ExpressBook Business Ledgers accounting software into a bespoke IPSAS-compliant solution. That is how we came out with ExpressBook PSA, which was released in 2015, after about two years of development and testing.

ExpressBook PSA is a full-featured IPSAS-compliant accounting solution for public sector entities. It has been customised to implement accrual-IPSAS in accordance with custom requirements. So far, we have successfully implemented IPSAS with ExpressBook PSA at both the Federal and State levels in Nigeria. Our field experience has helped us in moulding the software into a solution that has no close rival anywhere in the world. We have automated most of the IPSAS accounting policies and integrated them seamlessly with relevant government policies. One good example is our accommodation of the Treasury Single Accounts (TSA) in the accrual recognition of expense and tax liabilities.

Although ExpressBook PSA has been customised to implement IPSAS based on the domestication requirements of Nigeria’s public sector, we can, however, apply the same principle and customise the software to meet the domestication requirements of any jurisdiction implementing IPSAS anywhere in the world. ExpressBook PSA is available for immediate deployment, either on the premises as a client-server solution or as a cloud-based web service.

EXPRESSBOOK PSA EDITIONS

ExpressBook PSA comes packaged in one of the following editions:

ExpressBook PSA MDA Edition

Under IPSAS, each agency of the central government must prepare its own independent financial statements, outside the consolidated financial statements prepared by the central authority. ExpressBook PSA MDA Edition has been customised to serve as an ideal solution for all Federal Ministries, Departments and Agencies (MDAs). Special features in this edition include automated implementation of accrual accounting under the Treasury Single Account (TSA) system—features no other accounting software is capable of handling as of now. Computations and accounting for Value-Added Tax (VAT), Withholding Tax and Stamp Duty on an accrual basis are fully automated, requiring no user intervention.

ExpressBook PSA Consolidated Edition

ExpressBook PSA Consolidated Edition is meant for public sector entities that prepare consolidated accounts based on inputs from other sub-sectors. Typically, this can be the State or Federal government. ExpressBook PSA Consolidated Edition implements full accrual IPSAS, but also makes provision for cash-based IPSAS.

Although ExpressBook PSA comes loaded with convenient data entry tools, we have come to terms with the fact that many public sector entities, especially those at the State level, rely heavily on Microsoft Excel for their data input. Because of this, the Consolidated Edition of ExpressBook PSA has provided several data import templates to load data from Excel Spreadsheets into the system for financial reporting.

ExpressBook PSA LGA Edition

This edition of ExpressBook PSA is meant for Local Government entities. It borrows relevant features from the MDA and Consolidated editions to create a unique environment for Local Government accounting.

ExpressBook PSA Client

ExpressBook PSA Client allows MDAs to record their financial transactions and transmit the data online to the central server for consolidated reporting. Apart from uploading the data to the central server, it also comes with standard tools and utilities that allow MDAs to prepare their own independent financial statements, in accordance with the requirements of IPSAS. PSA Client can be enabled for cash accounting or both cash and accrual accounting.

ExpressBook PSA Transaction Broker

This edition of ExpressBook PSA is designed for entities using non-IPSAS-compliant accounting software, which they are not willing to jettison, but require a tool that will enable them to prepare their budgets in IPSAS-compliant format, as well as to produce IPSAS-compliant budget reports and financial statements.

With ExpressBook PSA Transaction Broker, you can continue to enjoy the cherished features of your existing software and have the benefit of IPSAS-compliant classification, budgeting, and reporting. Talk of living in two worlds simultaneously and enjoying both.

All editions of ExpressBook PSA are framed based on the classification and coding requirements of the National Chart of Accounts. Standard financial reports remain the same across all the editions. However, there are differences in custom features and reports.

EXPRESSBOOK PSA STANDARD FEATURES

ExpressBook PSA comes preloaded with the National Chart of Accounts and General-Purpose Financial Statements (GPFS) reporting templates. It also comes with a set of default system and application control parameters for easy deployment and setup.

ExpressBook PSA comes preloaded with all the standard parameters as default. This makes it possible to deploy and use the system without undue delays or difficulties..

Also included are data management tools and utilities to automate data entry, management, and control.

The following are some of the standard application modules of ExpressBook PSA:

Cashbook

This module sets up a subledger, linking each bank/cash account to a control GL account in the Chart of Accounts, and provides tools for the following cash transactions and reports:

- Cash Payments

- Cash Receipts

- Bank Reconciliation

- Reports

Accounts Payable

This module implements accrual recognition of expense through purchases from vendors/suppliers, as well as associated liabilities, in accordance with IPSAS recognition criteria. There are tools to perform the following tasks:

- Vendor Classification

- Vendor Registration

- Purchase Invoice

- Purchase Payment

- Reports

The MDA edition of ExpressBook PSA also accounts for the recognition of tax liabilities (Value-Added Tax, Withholding Tax and Stamp Duty) during Invoicing, and automatically derecognises them during Payment, in line with the operation of the Treasury Single Account (TSA).

Accounts Receivable

This module implements accrual recognition of Revenue in accordance with IPSAS. The following transaction recording tools are available in this module:

- Customer Registration

- Sales Invoice

- Sales Receipt

- Reports

Staff Receivable & Expenditure Requisition and Authorisation Processing (ERAP)

This module handles the management of internal cash, advanced to employees for official expenses. It also handles accounting for the expenses incurred on an accrual basis. The following transaction recording and management tools have been provided for carrying out the relevant tasks required in this module:

- Registration of Employees

- Cash Requisition

- Requisition Approval

- Cash Retirements

- Reports

Cash disbursements to employees are routed through the Cashbook payment.

Journals

The Journals module provides tools for direct and manual recording of double-entry transactions. ExpressBook PSA provides tools for the following four types of Journal entries:

- Standard Journal

- Auto-Journal

- Batch Journal

- Cross-currency Journal

Periodicals

This module provides tools for accrual recognition of Prepaid Expense and Unearned Income, in accordance with IPSAS.

Payroll Payment Voucher

This is a single tool that automates accounting for salary and wages on an accrual basis under the Treasury Single Account (TSA) or a decentralised cash/bank account.

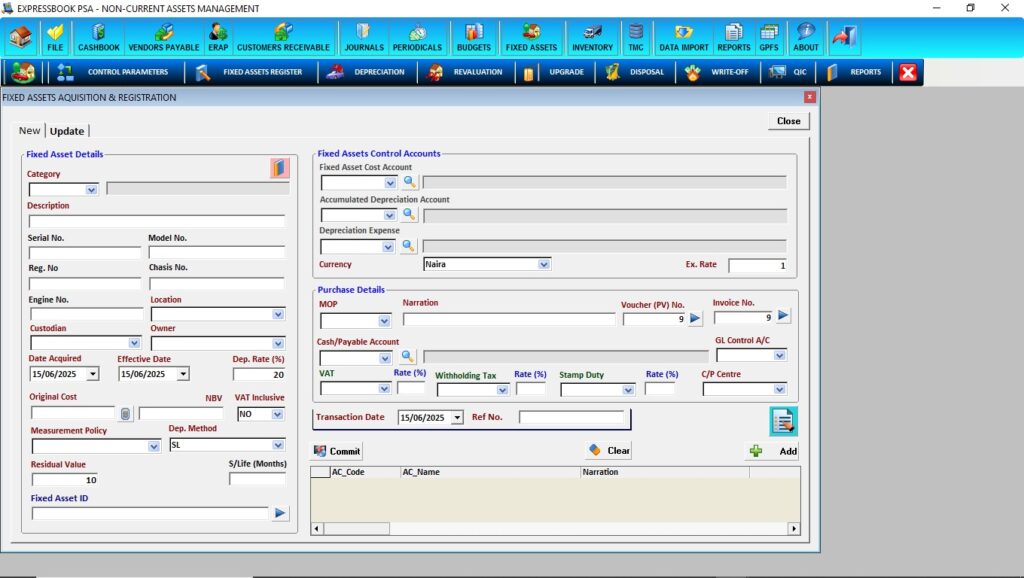

Non-Current (Fixed) Assets

Non-current (Fixed) Assets are given comprehensive treatment, in accordance with IPSAS accounting requirements. This module provides the following tools for fixed assets management and accounting:

- Classification of Assets

- Registration/Acquisition of Assets

- Depreciation of Asset

- Revaluation of Asset

- Asset Upgrade

- Asset Disposal

- Asset Write-off

- Reports

Inventory

This module accounts for inventory in accordance with IPSAS 12. Tools are available for carrying out the following primary tasks and for reporting:

- Classification & Coding of Inventory Items

- Opening Stock

- Purchase of Goods

- Materials Issue

- Inventory Update

- Reports

Budgets

This module handles the implementation of the Budget for the six Segments of the National Chart of Accounts, based on the standard template. The following tools are available for Budget management and reporting:

- Budget Setup & Updates

- Budget Rollover

- Budget Tracking & Performance Reports

Transactions Management & Control (TMC)

ExpressBook PSA provides two transaction processing modes: Real-time and Batch modes. When in a Batch mode, all transactions are subject to approval before they hit the General Ledger. However, the Real-time posts all transactions directly to the General Ledger. This module contains special tools required to manage and control transactions. The tools are as follows:

- Transactions Monitoring & Approval (TMA)

- Transaction Control Centre (TCC)

- GL Tracker

Security

The Security module manages users’ login security and permission settings, as well as the audit trail of users’ activities. The following security management tools are available in this module:

- Add Users

- Set Users’ Permission

- Change Login Group

- Reset Password

- Change Password

- Audit Trail

In addition to these application modules and features, there are special tools and utilities to perform the following categories of tasks:

- System Administration & Control

- Data & Transactions Management & Control

- IPSAS Transition Management

Other standard features of ExpressBook PSA include IPSAS-compliant financial statements and budget reports in various formats, with options to export data to PDF or Microsoft Excel. Our implementation also includes the General-Purpose Financial Statements (GPFS) and Notes (as prescribed by the Office of the Accountant-General of the Federation) and Segments reporting.

SPECIAL FEATURES OF EXPRESSBOOK PSA

ExpressBook PSA comes with bespoke features, some of which are difficult or impossible to imitate. The ExpressBook PSA advantage is derived from the fact that the development and implementation of the software were carried out with inputs from relevant stakeholders, including the FAAC’s Sub-committee on IPSAS implementation. Apart from the features listed above, there are custom features that put ExpressBook PSA in a class of its own. Below are some of those features:

Auto-computation and accrual accounting for Value-Added Tax (VAT), Withholding Tax and Stamp Duty, under the Treasury Single Account (TSA).

Accounting for taxes is a straightforward affair under the normal process of accounting. It requires the recognition of taxes as liabilities during payment to vendors, and subsequent derecognition by remitting these taxes to the government. However, under the Treasury Single Account (TSA), the recognition and derecognition of tax liabilities must happen automatically. ExpressBook PSA executes this procedure automatically without users’ intervention.

Note that this feature is only available in the MDA Edition of ExpressBook PSA, meant for federal Ministries, Departments and Agencies (MDAs).

Payroll Payment Voucher

Accounting for salary on an accrual basis requires the recognition of salary expenses and payroll liabilities, and subsequent derecognition of all payroll liabilities by remitting them to the government or the relevant authority.

Payroll Payment Voucher is a custom tool for the recognition of payroll expenses and liabilities (PAYE, Pension, National Housing Fund, National Health Insurance) on an accrual basis as well as the de-recognition of these liabilities by automatic remittance via the Treasury Single Account (TSA). All the computations and associated accounting entries are carried out automatically without any user intervention.

Automatic remittance of payroll liabilities via the TSA is optional.

Dual Transactions Processing Modes

ExpressBook PSA provides two transaction processing modes, namely, Real-time and Batch processing modes.

Real-Time

When in Real-Time mode, all transactions posted by individual users update the General Ledger immediately they are posted. This may be the preferred mode for entities where there are personnel constraints, or where centralised approval of transactions could cause enough delay to disrupt real-time reporting.

Batch Mode

When in Batch Mode, all transactions are subject to verification and approval before they are uploaded to the General Ledger. The task of verifying and approving the transactions is a dedicated one and requires the System Administrator’s permission.

This feature may not appear like a special feature, but there are a few things that make our implementation special. They include the following:

- The provision of optional dual processing modes gives users the freedom to choose their preferred processing mode

- Availability of several analyses and reporting tools for data verification and authentication before approval

- Ease of use

IPSAS Transition Management

ExpressBook PSA comes with a special utility called, IPSAS Transition Toolkit to manage a smooth migration from your previous accounting system (whether manual or computerised) to the IPSAS-compliant environment of ExpressBook PSA.

The toolkit contains tools to handle the following tasks:

- Account Codes Mapping (to map your current account codes to codes in the National Chart of Accounts).

- Transition Opening Balance (to import the closing balance from your previous accounting system into ExpressBook PSA as the opening balance).

- Transition Journal (allows you to import all the journal entries from your previous accounting system into ExpressBook PSA). This is optional.

General-Purpose Financial Statements and Disclosures

ExpressBook PSA comes with tons of standard and special reports for financial and budget reporting to meet your requirements. In addition to these, we can proudly say ExpressBook PSA is the only accounting software that has implemented the General-Purpose Financial Statements (GPFS) and the Notes to the Financial Statements in the format prescribed by the Office of the Accountant-General of the Federation. The system also provides standard and custom financial reports for each of the six segments of the National Chart of Accounts.

DEPLOYMENT OPTIONS

ExpressBook PSA can be deployed, either as a client-server solution on the premises over a Local Area Network, or as a Cloud-based web service, which can be accessed via a web-enabled device from anywhere.

Software and Hardware Requirements

ExpressBook PSA can work with any of the following databases:

- Microsoft SQL Server

- MySQL

- Oracle

- Jet (Microsoft Access Database)

Client-server Deployment requires the following hardware and software:

- Windows Server (2005 or above), running Microsoft SQL Server (2005 or above) or any of the compatible databases listed above, with at least 4 GB of RAM, at least 100 GB of disk space (Jet database does not require a dedicated database server).

- Workstation PCs with at least 4 GB of RAM and not least 10 GB of disk space.

- Local Area Network connectivity.

Public Cloud deployment requirements are based on infrastructures provided by available subscription packages, but Private Cloud deployment requires a Windows Server (with at least 8GB of RAM), an internet connection with a static public IP Address, in addition to other requirements.

BEYOND THE STANDARD REQUIREMENTS

IPSAS is policy-based. The Standards only provide a framework for public sector accounting, and not the specifics. That leaves each jurisdiction with the task of domesticating IPSAS to meet its special requirements, without violating the Measurement and Recognition policies of the Standards.

The domestication requirements of IPSAS make it impossible to find an off-the-shelf software that can address all the accounting issues of all public sector entities across jurisdictions, or even for all public sector entities within the same jurisdiction. This is why we have built different editions of ExpressBook PSA, customised to meet the special requirements of Federal, State and Local government entities. For example, at the Federal level, our implementation of the accrual IPSAS takes cognisance of the Treasury Single Account (TSA), but this feature is optional, for the benefit of those public sector entities operating outside the TSA.

We are sensitive to the custom features that make each edition unique, and we remain ready to customise ExpressBook PSA even further to accommodate any domestic requirements of any public-sector entity within any jurisdiction anywhere in the world.

Our team of experts can also assist you in handling all your local domestication requirements and managing all your IPSAS transition and compliance activities.